Applying tax and custom taxes to a Customer

1. When tax is applied to a customer the system uses the local standard tax rate. If a different tax rate is required, a custom tax can be added.

TIP! SHORTCUT: Type the customer name into the global search feature, located in the top right corner of each page. This will bypass steps 2 -4.

TIP! "Apply tax to invoices" must be enabled in the system setting before taxes can be set up for a Customer.

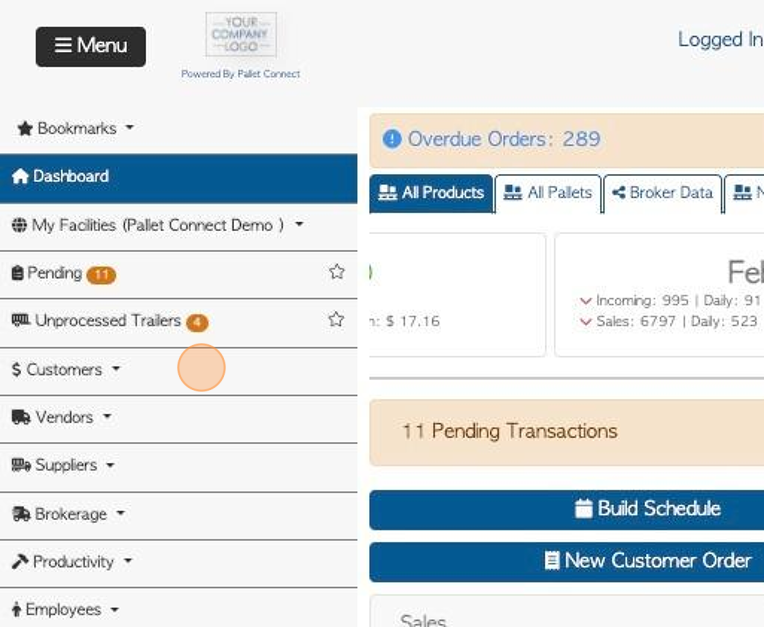

2. Navigate to the main menu. Click "Customers"

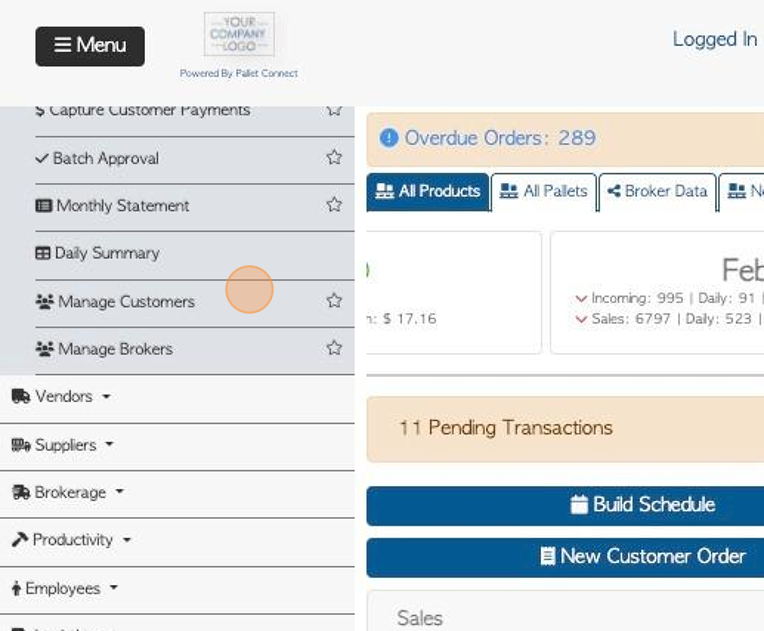

3. Click "Manage Customers"

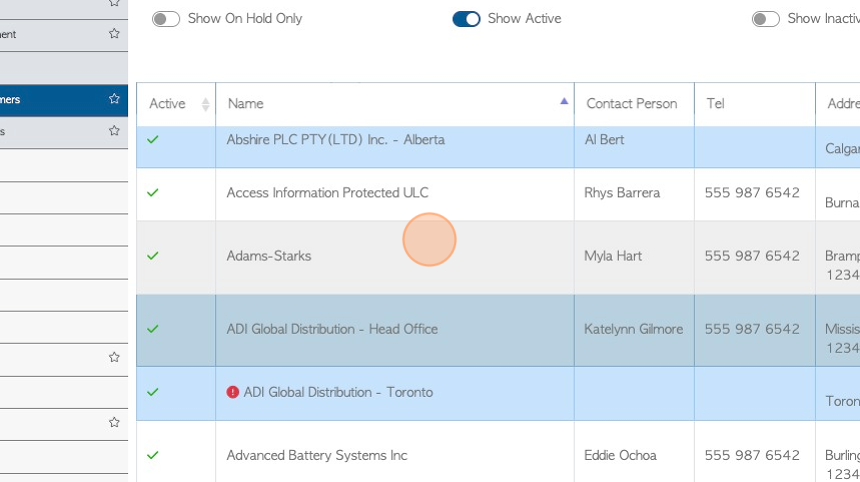

4. Click the selected company from the list.

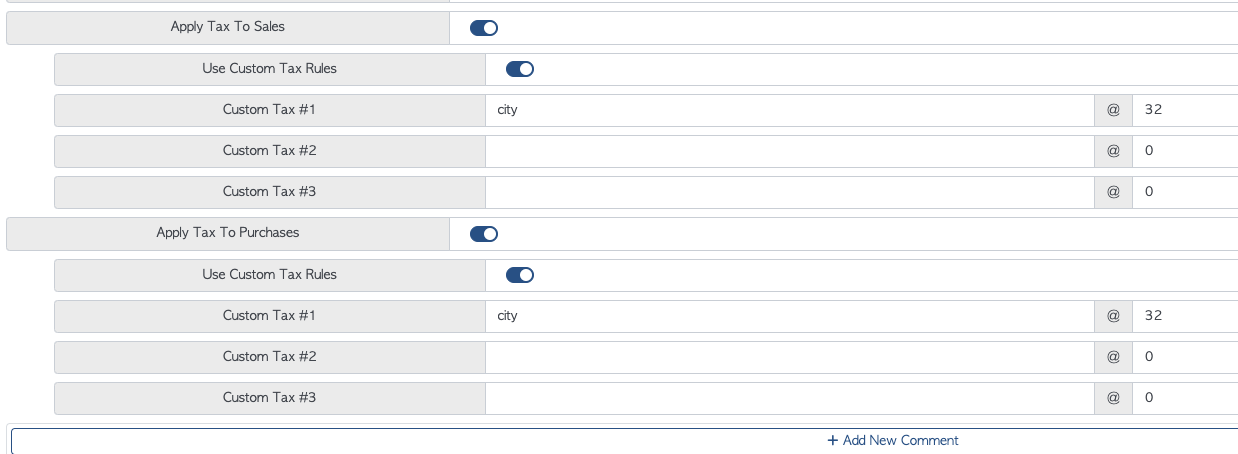

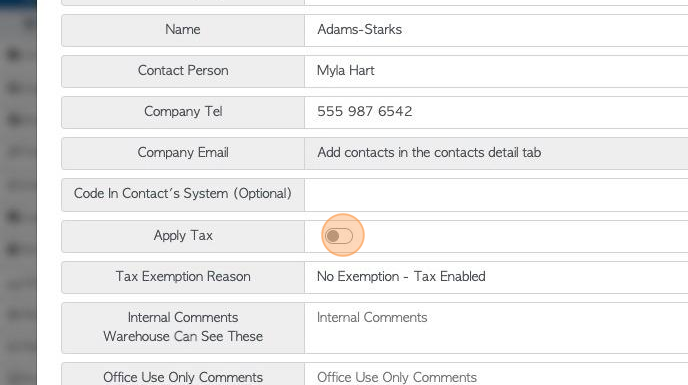

5. Click on the "Apply Tax" toggle button, from the General tab in the Customer profile.

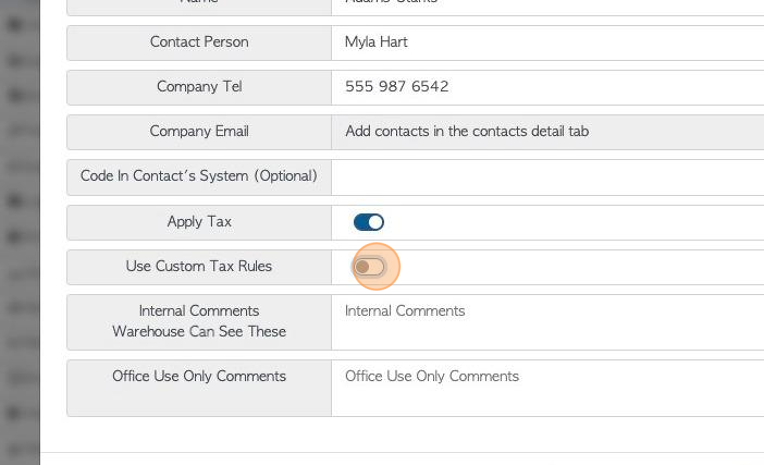

6. If "Apply tax" is on but custom tax is toggled off, then regular sales tax for the region, is applied.

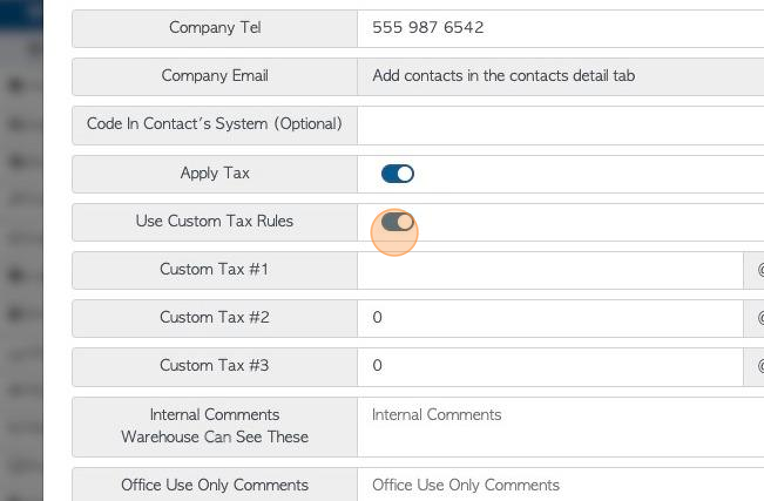

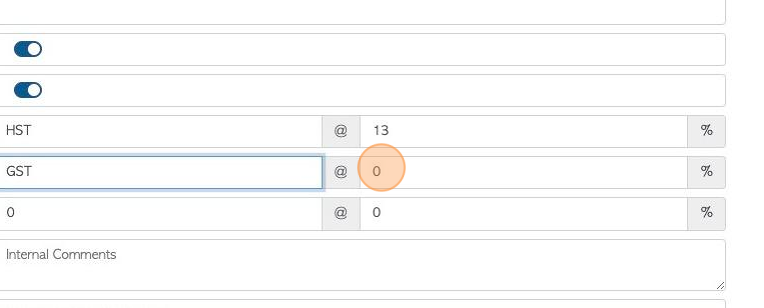

7. Click this field to toggle on "Custom Tax Rules".

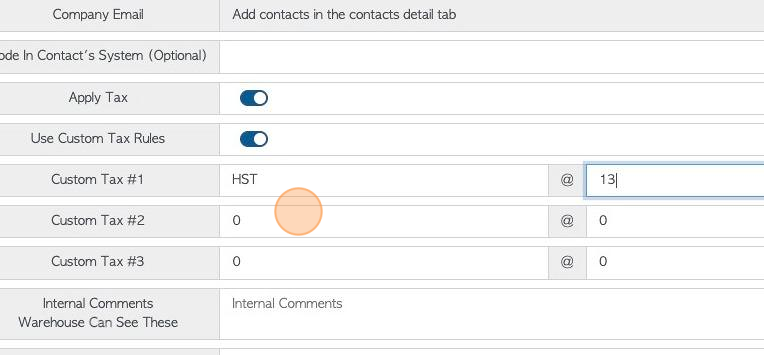

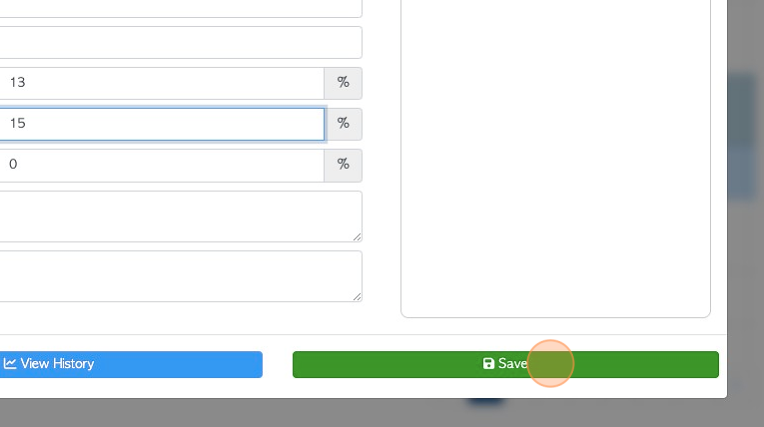

8. Type in the tax name and the percentage amount.

9. There is room to add up to 3 different taxes, that will be applied to the Customer order.

10. Click "Save" to complete.

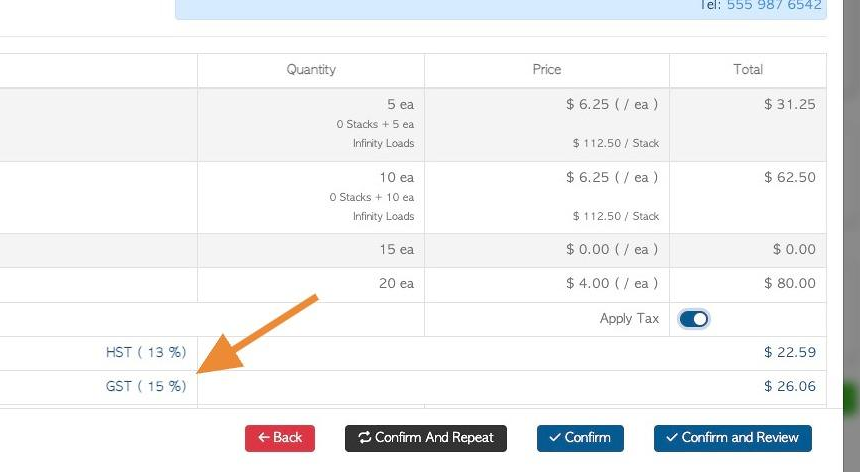

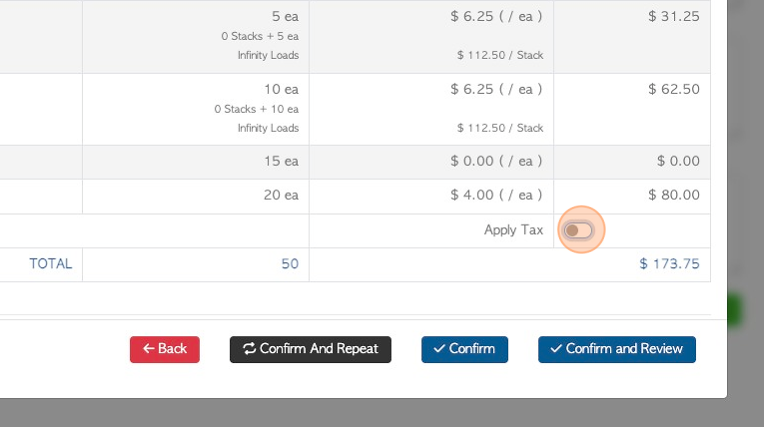

11. Those taxes will now show up on a Customer transaction.

12. TIP! Tax can be removed from an invoice after an order is placed, if needed. Use the "Apply tax" toggle button on the order or invoice.

TIP! Tax can also be set at the item level. See related article re. applying tax to a stock item.

NOTE: If the contact is a Customer and a Supplier or Vendor, the tax rate can be set separately for sales and purchases.