QuickBooks Online - Mapping Accounts

The first time you connect to QuickBooks online you will be asked to map your tax rates and your sales and purchases accounts.

You will only need to do this once for every stock category.

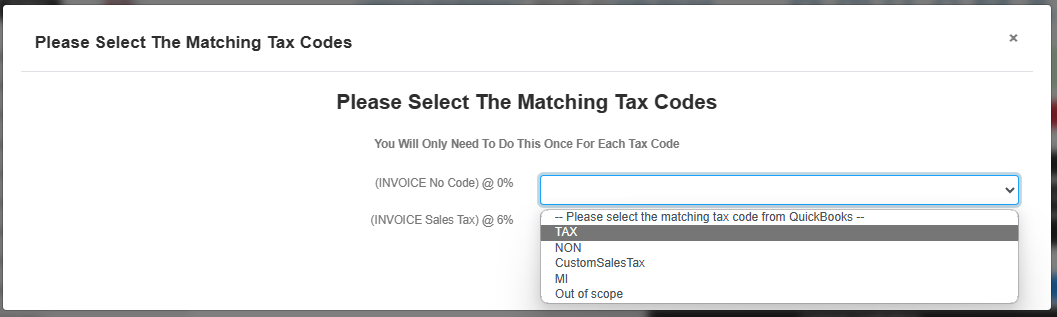

Map Tax Rates

US Customer:

- map TAX to all tax rates above 0%

- map NON to all exempt or 0% rates

Non US Customers

- Map the matching tax rate to the one in QuickBooks

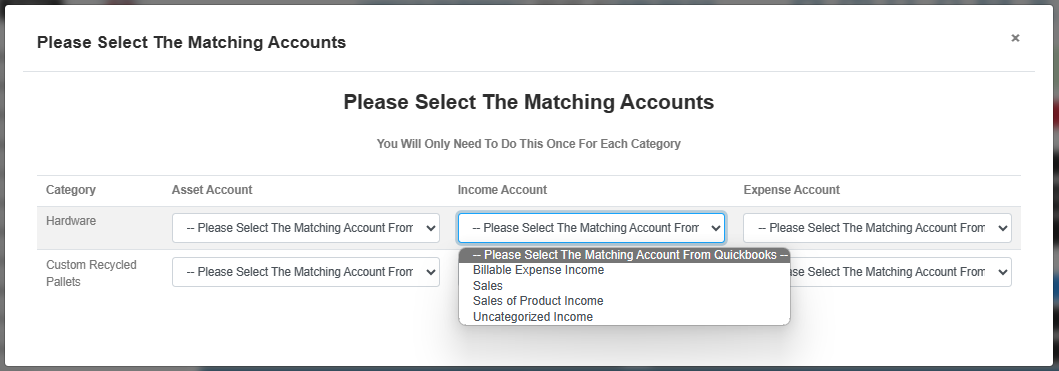

Map Accounts

Choose the accounts you want the transaction recorded under for each stock category. The mapping accounts specifically look for account types from Chart of Accounts like this.

Asset Accounts - (account type) “Other Current Asset”

Income Accounts - (account type or detail type) “Sales of Product Income”

Expense Accounts = (account type) “Cost of Goods Sold”

If using Custom Fields, please see the following article